Struggling to plan for assisted living expenses? Now is the time to dig in—not give up. Though the process can be complex and confusing, the reward for early preparation will be a stress-free and enjoyable transition from independent to assisted living. As I always say—it’s never too late to prepare but the sooner you get started the better!

How Much Is Assisted Living? It Depends

Assisted living costs vary widely depending on a senior’s particular care needs and chosen facility. Luckily, seniors have many options for paying for senior care. Uncover the ins and outs of assisted living costs and the different ways seniors can fund their stay in one of these facilities in this post.

What Is the Average Monthly Cost for Assisted Living?

How much does assisted living cost? Though the different levels of care and services offered at assisted living facilities make this hard to estimate, we can provide the average cost of assisted living.

According to the national average, residence in an assisted living facility typically costs between $4,000 and $5,000 per month. However, the cost can increase based on location, apartment size and features, level of care, and selected amenities. When a senior moves into an assisted living facility, the staff will assess their transportation needs, cognitive capabilities, health conditions, and required assistance with activities of daily living (ADLs). This assessment of mental and physical faculties will be used to determine the amount of care a person will need and the final cost of assisted living.

What is the Cost of Assisted Living for Low Income Families?

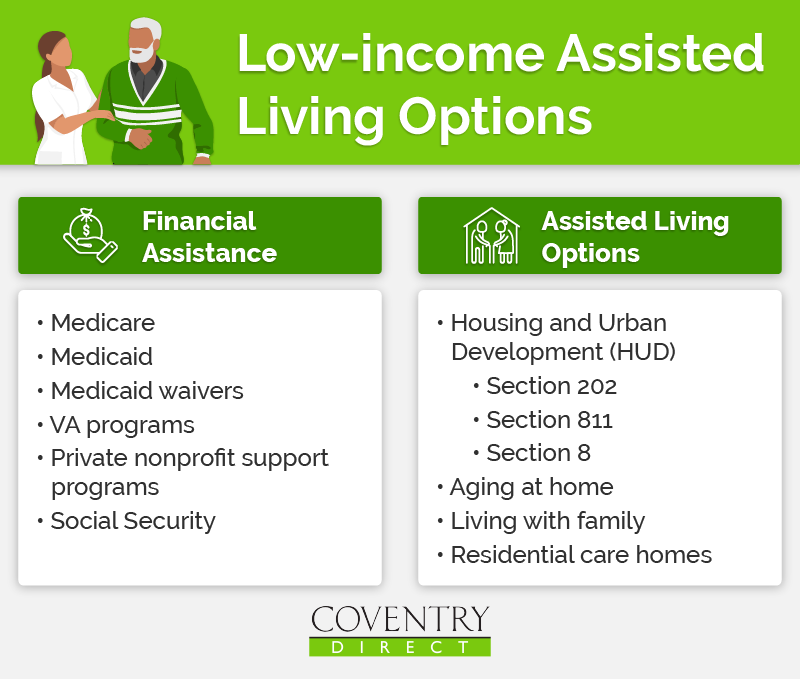

Assisted living costs can be a significant financial burden for low-income families, making it difficult to secure quality care for their loved ones. However, there are some programs and special benefits available to help cover the costs of assisted living for eligible individuals. Qualifications for the following options are typically based on income level, assets, and care needs.

Medicaid

Medicaid is a government program that provides health coverage to low-income individuals, including seniors needing long-term care services such as assisted living. While Medicaid rules and coverage vary by state, many states offer waivers or programs specifically designed to cover assisted living costs for those who meet eligibility requirements. Contact your state’s Medicaid program for more detailed information.

Supplemental Security Income (SSI)

SSI is a federal program that gives monthly payments to elderly or disabled individuals with limited income and resources. Some states supplement SSI payments with additional funds to help pay for assisted living costs. Eligibility criteria often include income and asset limitations and residency requirements.

Veterans Benefits

Veterans and their spouses may qualify for assisted living benefits through the U.S. Department of Veterans Affairs (VA). For instance, the Aid and Attendance (A&A) benefit provides additional financial assistance to veterans and surviving spouses who require help with daily activities due to a disability or health condition.

To qualify for Aid and Attendance benefits through the U.S. Department of Veterans Affairs (VA), individuals must meet specific criteria related to medical condition and financial need:

Medical Conditions

The applicant must require the assistance of another person with activities of daily living.

Individuals confined to a bed due to disability or chronic illness, residing in a long-term care facility due to physical or mental illness, or living with severe visual impairment may also qualify.

Financial Need

The applicant’s countable family income must be below the maximum annual pension rate set by Congress.

The veteran’s net worth must be under $138,489

Section 202 Supportive Housing for the Elderly Program

The Section 202 Supportive Housing for the Elderly Program, administered by the U.S. Department of Housing and Urban Development (HUD), provides affordable housing options and support services tailored to the needs of low-income seniors. Under this program, eligible individuals can access rental assistance in designated housing developments specifically designed for elderly residents. These developments often offer amenities such as communal spaces, transportation services, meal programs, and access to on-site supportive services, including assistance with activities of daily living and coordination of medical care. Section 202 aims to promote independent living and enhance the quality of life for seniors in need of affordable housing and support.

Long-Term Care Insurance

Long-term care insurance policies can help cover the costs of assisted living services. While premiums can vary based on factors such as age, health status, and coverage options, some policies offer benefits specifically for assisted living expenses. It’s crucial for families to look closely at the policy’s coverages and premiums, as some may provide little care for a premium similar to the cost of assisted living itself. Low-income individuals may explore more affordable insurance options or seek assistance from state programs to obtain coverage.

Non-Medicaid State Assistance

Non-Medicaid state assistance programs offer financial aid, caregiver support, and housing assistance to low-income seniors outside the Medicaid framework. These programs vary widely by state and can provide services such as cash benefits, home and community-based services waivers, and subsidies for assisted living or long-term care. Eligibility criteria often consider income, assets, and level of need, providing additional support to seniors who may not qualify for Medicaid but require assistance with housing and caregiving expenses.

What Is Included in Assisted Living Costs?

In addition to being a big life decision, entering assisted living is an important financial decision. Assisted living costs provide residents with housing accommodations, the option of prepared meals, and medical care.

Housing

Most assisted living communities offer apartment-style residences with one or two-bedroom units, a kitchen, bathroom, internet, and cable. Apartments typically come with safety features such as handrails and alert devices to accommodate physical impairments. Residents can bring their furniture and belongings to their apartment and receive assistance with tasks like housekeeping and laundry. The cost of housing will depend on the apartment size, selected services, and other related factors.

Medical Care

The level of medical care and personal assistance provided at assisted living facilities can vary, though residents are expected to be relatively self-sufficient. Assisted living costs will increase or decrease with the level of daily care seniors receive. Those who can take care of themselves with minimal assistance will require limited medical services, reducing assisted living costs. Those who need considerable assistance to function regularly will require a higher level of medical care, increasing the cost. If the need for care exceeds the abilities of the facility, a resident could hire outside home care assistance or begin planning a transition to a skilled nursing facility.

Food

Assisted living communities offer significant flexibility throughout their living experience, and seniors can enjoy considerable flexibility around their dining experience and food preparation. Residents can choose to cook for themselves or receive food prepared by the facility. Those who prepare their meals themselves will pay less than those who eat facility-provided meals. The food served in assisted living communities can be high-quality and personalized to dietary requirements. Seniors can enjoy a community dining experience, often in a restaurant, resort, or hotel-style setting with other residents.

Is There Any Financial Assistance for Assisted Living?

For many seniors, paying for assisted living is a daunting prospect, especially for those in need of assisted living for low income. While it is important to plan ahead and be prepared for the eventual need to pay for assisted living, there are options available to seniors who may not be able to fully cover the costs involved.

Does Medicaid or Medicare Cover Assisted Living Costs?

In discussions about senior care costs, the common question is, “Does Medicaid or Medicare pay for assisted living expenses?” While Medicaid and Medicare typically do not cover assisted living costs, the specific answer to this question depends on several factors and varies from state to state. In addition, the level of coverage will ultimately depend on the senior’s health conditions and other specifics.

Government assistance alone, including Social Security, will not fund assisted living expenses, especially if a senior has specific geriatric needs. Therefore, it is best to develop a supplementary payment method. Assisted living is primarily a private pay environment requiring financing options such as the sale of a home or other assets, LTC life settlements, long-term care insurance, VA Aid & Attendance Benefits, and Senior Bridge Loans.

Are There Veterans Benefits for Assisted Living?

Veterans benefits are a great way for eligible seniors to contribute to their senior care income. Several veterans’ aid and pension options provide money for veterans’ assisted living costs or their single surviving spouses and dependent children.

For example, VA Aid and Attendance Benefits provide a monthly allowance for qualifying veterans who served active duty during wartime and were honorably discharged. In 2021, the monthly pay range seniors could spend on long-term care from the VA Benefit is:

Veteran= $2,050

Veteran and Spouse= $2,431

Surviving Spouse= $1,317

Two Married Veterans= $3,253

To receive veterans benefits for assisted living costs, seniors must apply and provide information about their income and assets, level of independence, and current medical conditions and/or disabilities. Senior veterans’ physical or mental impairments do not have to be a product of military service to qualify.

Assisted Living vs Nursing Home Cost: What’s the Difference?

If a senior you know is considering entering an assisted living facility, they are likely considering another form of senior care: nursing homes. Unfortunately, understanding the difference between assisted living and nursing homes can be difficult. Although nursing homes and assisted living offer care and personal assistance, these two forms of long-term care vary widely in their levels of care, services, and costs.

Assisted living facilities primarily offer care to seniors in reasonably good health who are no longer capable or want to live alone. Rather than providing skilled medical care, assisted living facilities offer more assistance with everyday activities such as dressing and bathing. In contrast, nursing homes tend to individuals with severe health conditions that require significant medical care and assistance with ADLs, and medication management.

Because they provide much more extensive healthcare than assisted living facilities, nursing homes cost over twice as much per month on average. While this hefty cost places a heavy financial burden on seniors, nursing homes provide comprehensive care from skilled medical professionals. For example, suppose an aging senior was bound by a bed or wheelchair, in the late stages of a cognitive illness like dementia, or had complex treatment needs. Nursing homes could provide them with the constant care they need to manage the most advanced health conditions. Medicaid is the primary payor of nursing home costs in the U.S., but to qualify an applicant would need to meet asset and income limits placing them below the poverty line.

How to Pay for Assisted Living Costs

It’s time to get into the different ways seniors can pay for assisted living costs. Whether it’s cash, health insurance, or life insurance—the section below provides an overview of the various methods seniors can use to fund their residence in an assisted living facility.

Long-Term Care Insurance

Long-term care insurance offers a smart way to cover assisted living expenses for those looking ahead at future senior care costs. Like many state and federal assistance programs, long-term care insurance has eligibility requirements that depend on the type of policy a senior pursues. While long-term care insurance can help seniors pay for assisted living costs, this type of insurance can be expensive and typically covers a fixed period.

Out of Pocket

When seniors have sufficient funds, they can pay out of pocket for long-term care. It allows them to access high-quality living assistance without dealing with an insurance policy or navigating Medicare and Medicaid restrictions. Cash reserves from personal savings can fund out-of-pocket payments. Also, the sale of assets, such as a vehicle or home that a senior will no longer need can fund these payments.

Life Insurance

Seniors who are looking for more affordable assisted living options, and who have life insurance, can sell their policy in return for a cash sum or long-term care benefit account, which they can use to fund long-term care. This type of policy sale is called a life settlement. It allows seniors to get a much more generous payout, on average 5-10 times greater, than they would by canceling their policy or letting it lapse.

Qualifying policy owners can receive a portion or, in some cases, all of a life settlement’s payout free of taxes. Proceeds equal to or less than the sum of the premiums the policy owner has paid on their policy, called the tax basis, will not be subject to taxation. In addition, if the insured person is terminally ill or chronically ill, the policy sale is called a viatical settlement, and the proceeds are tax-free. All assisted living communities will accept funds from a life settlement being held and administered through a Long-Term Care Benefit Account. A recently reintroduced congressional bill could even make life settlement proceeds tax-free for everyone through a long-term care benefit account.

Know the Options Available for Paying for Assisted Living Costs

The decision to give up a degree of independence can be a difficult moment in any senior’s life. Assisted living facilities do their best to make this transition as positive and gratifying as possible. Though some may be concerned about finding a way to pay assisted living costs, seniors today have many options to help them finance this important senior expense.

Retirement Genius can help seniors understand all of their financing options—from life settlements to long-term care insurance. Our retirement experts are here to guide seniors through the early preparation phase and plan a happy, healthy, and fulfilling retirement. To see how our years of experience and accumulated expertise can help you meet your retirement goals, contact Retirement Genius today.

View Transcript

Retire like a genius. How to become a long-term care genius? Ways to pay for long-term care when you need it now. Long-term care is a topic most people don’t want to think about and way too few people are financially prepared for. The expensive costs of home care, assisted living communities, memory care, and nursing home care. But the reality is that 70 percent of people over the age of 65 will need to pay for long-term care services in their lifetime. For the lucky few that have long-term care insurance or enough money to pay out of pocket for what they need they’ll be able to choose the type of care and location that they want. So what can people do if they don’t have the ability to pay for these services at the time they need them. Many people don’t realize that they actually have access to a variety of funding resources that could be sitting in their hands right now. So here are financial options to consider when you need to pay for long-term care now. One life settlements, Sell off an unneeded or unwanted life insurance policy to access tax Advantage Funds that can be used to pay for any form of long-term care. Two reverse mortgage, a lone taken out against the equity in a home without the need to make monthly loan payments that can be used to pay for home care services. Three VA aid and attendance benefit, veterans and or a spouse can access a monthly benefit to pay for long-term care costs if they meet eligibility requirements. Four annuities, can be used to create a guaranteed monthly income to help pay for long-term care services for the remainder of a person’s life. Five senior bridge loans, a loan to pay for care that’s needed today taken out to bridge the time it takes to sell a home to fund care for the long term. Six true freedom plan, a prepaid membership plan that will cover different levels of hours of Home Care Services in the future when they are needed. It’s important for people to do all they can to prepare for their future retirement and long-term care needs. But for those who have not adequately prepared and are now facing an immediate need for care they have more financial options available to them than they may have realized. Retire like a genius it’s always best to work with information and experts to help you navigate these tricky issues so visit retirement genius today to learn more about how to retire like a genius.