Saving for retirement can be a little like planting a tree. At the start, you have just a small sapling that needs nurturing. Every month, you pour a little of your income into your retirement account, just like you would provide water, sunlight, and nutrients to a growing sapling. At first, the tree may seem small, just like your budding retirement savings. But over time, as you care for it consistently, the trunk begins to grow and your sapling begins to transform into a beautiful, strong tree. Similarly, as you consistently contribute to your retirement savings over the years, your nest egg starts to accumulate and grow into a much bigger fund. Over time, the initial investments, like drops of water, begin to compound, generating returns and increasing the value of your account.

Caring for your 401(k) takes hard work, patience, and an understanding of how things work. In this article, we’ll explore the most popular retirement savings option in the United States: the 401(k). Learn the basics of how this kind of retirement savings account works and some tips on maximizing savings to use in your golden years.

What Is A 401(k)?

Let’s start from the very beginning: what is a 401(k), exactly? A 401(k) is a retirement savings plan that employers offer to their employees. It allows working individuals to contribute some of their pre-tax income to a retirement investment account. The funds in a 401(k) are invested into stocks, bonds, mutual funds, or target-date funds and grow over time, building a stockpile of cash to use in retirement. Employers may choose to match contributions, boosting the employee’s overall nest egg.

There are many different types of 401(k) plans, but here are the three most common:

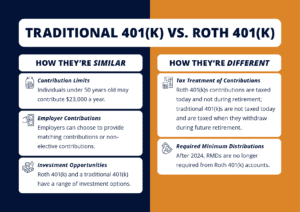

- Traditional 401(k): Considered to be the most common kind of 401(k) plan, a traditional 401(k) is employer-sponsored and money contributed grows tax-deferred. During retirement, when you begin using your 401(k) as income, you will be taxed on the money you pull out.

- Roth 401(k): Contributions to a Roth 401(k) are made with after-tax dollars. Contributions are made through payroll, like a 401(k), but they’re with post-tax income. When you use money from your Roth 401(k) in retirement, you will not be taxed on that income.

- SIMPLE 401(k): Smaller businesses with fewer than 100 employees may offer their team a SIMPLE 401(k). Employers who offer a SIMPLE 401(k) plan must match their employees’ contributions up to 3% or contribute 2% of pay for each employee.

Other types of 401(k) include: safe harbor 401(k), and solo 401(k). The type of 401(k) you have highly depends on what your employer offers.

What Are the Benefits of Having a 401(k)?

Contributing to a 401(k) has many advantages, including tax-free contributions, flexibility, and employer match.

Tax Advantages

Depending on your type of 401(k), your contributions have tax advantages. With most 401(k) plans, you contribute pre-tax income to your retirement savings. The tax deductions are deferred until retirement when you take money out of your 401(k) to use as income. This can be an advantage to folks who plan on being in a lower tax bracket during retirement. Plus, contributing to your 401(k) today makes your current taxable income lower.

Flexibility

A 401(k) provides a lot of flexibility in terms of how much you contribute and where you can invest it. As of 2024, you can contribute up to $23,000 for individuals under 50 years old and up to $26,000 for folks 50 years and older, allowing you to save a significant amount towards your retirement. Plus, you can tailor your investment portfolio based on your risk tolerance. Finally, your 401(k) sticks with you, even if you move on to another employer. You can always roll your 401(k) to your new employer.

Employer Match

Another major benefit of contributing to your 401(k) retirement account: employers may match your contributions! It’s a tax advantage to employers to match employee contributions, so companies often offer 401(k) matching as a benefit to their employees (and themselves). Generally speaking, employers match up to 3% – 6% of your contributions, providing you a free boost to your retirement savings.

Types of 401(k) Accounts

Not all 401(k) accounts are created equal. There are different types of 401(k) accounts, each with its own savings and investment methodologies. Let’s explore how two prominent types of 401(k)s operate: the Roth 401(k) and the traditional 401(k).

Traditional 401(k)

Many employers offer a traditional 401(k) to employees, allowing them to allocate a portion of their career salary to a retirement investment account. This contribution is pre-tax, so it’s taken out of your paycheck before taxes are collected. Later, when you withdraw funds from your 401(k) in retirement, you’ll be taxed on the amount withdrawn.

You have control over where your 401(k) funds are invested, based on your risk tolerance. You can place your money in conservative, moderate, or aggressive investment vehicles when managing your traditional 401(k).

Finally, you’re allowed to begin withdrawing money from your 401(k) when you turn 59½ years old, and by age 72 you’re required to collect required minimum distributions (RMD) from your 401(k). Required minimum distributions exist so that the government can count on collecting taxes on your income.

Roth 401(k)

A Roth 401(k) combines elements of both a Roth IRA and a traditional 401(k). You can contribute after-tax income into an account specifically designed for retirement savings. When you withdraw money from your Roth 401(k) during retirement, your income will not be taxed since it has already been taxed before.

A Roth 401(k) has a similar contribution structure to a traditional 401(k). People under the age of 50 may contribute up to $22,500 a year and folks 50 years old or older can contribute an additional $7,500. A Roth 401(k) also follows the required minimum distribution rule like a traditional 401(k): people 72 years old or older are required to collect RMDs from their Roth 401(k).

How Does a 401(k) Work When You Retire?

A traditional 401(k) is a retirement savings plan many employers offer employees as a benefit. It’s a tax-advantaged account that allows employees to contribute some of their pre-tax income into a retirement investment account designed to grow over time. The money that’s contributed to a 401(k) financial account is invested into stocks, bonds, and mutual funds and grows conservatively, moderately, or aggressively, depending on your risk tolerance.

Here’s how it works: you decide how much of your paycheck should contribute to your 401(k). Experts typically suggest contributing 10% to 15% of your income towards your 401(k). Then, that pre-tax amount is automatically deducted from your paycheck and distributed into your 401(k) investment account. The benefit of having pre-tax dollars go directly toward your 401(k)) is twofold: first, this reduces your taxable income for the year. For example, if your annual salary is $60,000 and you contribute $6,000 (or 10%) toward your 401(k), your taxable income for that year would be reduced to $54,000. Second, you won’t be taxed on this income until retirement, during which you may fall into a lower tax bracket. Finally, the funds are invested in different securities (stocks, bonds, mutual funds).

There are several things to consider with your 401(k) as you plan for retirement:

- If you begin collecting early, you could pay more in taxes. You can begin withdrawing money from your 401(k) when you turn 59 ½ without penalty. However, if you retire early and want to use funds from your 401(k), you can expect to pay an additional 10% in income taxes.

- Your 401(k) income will be taxed — plan withdrawals accordingly. Since you didn’t pay taxes when you contributed funds to your 401(k), you will be taxed when you take out cash from your 401(k) in retirement. Plan accordingly so you can incur the smallest tax bill possible. You want to be sure to hit a lower income bracket than when you contributed funds to your 401(k) in the first place.

- Penalties can occur if RMDs are not withdrawn. After you reach 72 years of age, you’re required to withdraw a portion of your 401(k) every year. If you do not take the RMD, the amount not withdrawn will be taxed 50%.

There are many rules, regulations, and strategies to consider as you make retirement plans — it can be tough to keep them all in mind. To maximize your 401(k), consider the following savings tips.

Tips to Maximize 401(k) Balance

Maximizing your 401(k) in retirement requires consistent effort, long-term planning, and informed decision-making. Here are some ways you can optimize your retirement savings and work toward a financially secure future!

- Start Early

Starting your retirement savings early can help you unlock the power of compounding growth. Starting early gives your investments more time to accumulate and benefit from compounding returns. - Leverage Employer Match

Take full advantage of employer match if it’s offered by your company. Why? It’s free money! If your employer offers a matching contribution, contribute at least enough to maximize the match because it’s an instant return on your investment. - Increase Contributions Regularly

Make it a habit to review and increase your 401(k) contributions over time. For example, if you start saving 10% of your income, bump up your contributions by half a percent or a full percent every year or as you make more money. The more you save now, the faster your money will grow over time. - Diversify Your Investments

Diversification can mitigate risk and maximize potential returns. Rather than allocating all of your 401(k) contributions to one asset class, diversify across different asset classes. You can work with a financial advisor to create a well-diversified portfolio with assets that reach your goals. - Take Advantage of Catch-Up Contributions

Once you turn 50, you can make catch-up contributions beyond the regular annual 401(k) limits. Taking advantage of catch-up contributions allows you to significantly boost your retirement savings (especially if you haven’t been able to contribute as much in earlier years). - Contact a Financial Advisor

The earlier you can work with a financial advisor you trust, the faster they can help you create a personalized investment strategy that pivots over time with your life goals, circumstances, and income fluctuations. Not only can they help with your 401(k), but they can help with the bigger picture of your retirement strategy, including annuities, life settlements, long-term care plans, and more. A professional’s guidance can help you make informed decisions for your future.

Your 401(k) Plan: Key Takeaways

Just as tending to a sapling requires patience, attention, and regular care, maximizing your 401(k) demands consistent effort, long-term planning, and pivoting strategies. By starting early, leveraging employer matches, seeking guidance from financial advisors, increasing contributions regularly, and more, you can cultivate a strong and resilient retirement fund. Remember: every contribution you make and every adjustment you implement acts as nourishment for your retirement tree, helping it grow tall and provide shade for your future. So plant the seed today, tend to it diligently, and watch your 401(k) flourish, providing you with a fruitful retirement!